Ready to get into the detail of a 100% LVR loan?

Meet Julie and Lewis*, OwnHome clients who crunched the numbers and discovered they were better off with OwnHome vs a high LVR loan.

Client profile

Julie and Lewis are Sydney-based working professionals in comms and engineering. They immigrated to Australia five years earlier.

They have a high household income but can't opt for a 20% deposit.

Loan Profile

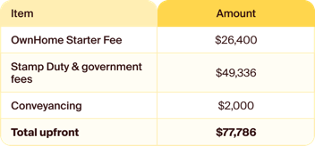

Costs - Upfront

Costs - Ongoing

Lewis and Julie considered a 5% deposit loan, but needed an estimated $168,222 to move forward— $60,000 in deposit and $55,236 in LMI fees. LMI was more expensive upfront than OwnHome.

Who is the OwnHome customer?

Is a 'prime' borrower, just not the deposit to move forward

Holds permanent Australian residency or Australian citizenship and reside in Australia

Does not have a 20% deposit saved

Has at least 2% of the property value as genuine saving

Can service monthly repayments

Has a great credit score